Opinion

- Home

- Content and Events

- Opinion

Real-world insights into the sectors we work with.

With our exposure to so many sectors around the globe we have a deep understanding of what the current opportunities and challenges are.

Here, you can find sales-i's latest opinions, thoughts and analysis around the manufacturing, wholesale and distribution sectors globally, with economic impacts that converts businesses to a technological change – and why.

From thought leadership pieces, to coverage on disruptions within specific industries, below read our honest opinions of business environments.

Filter by:

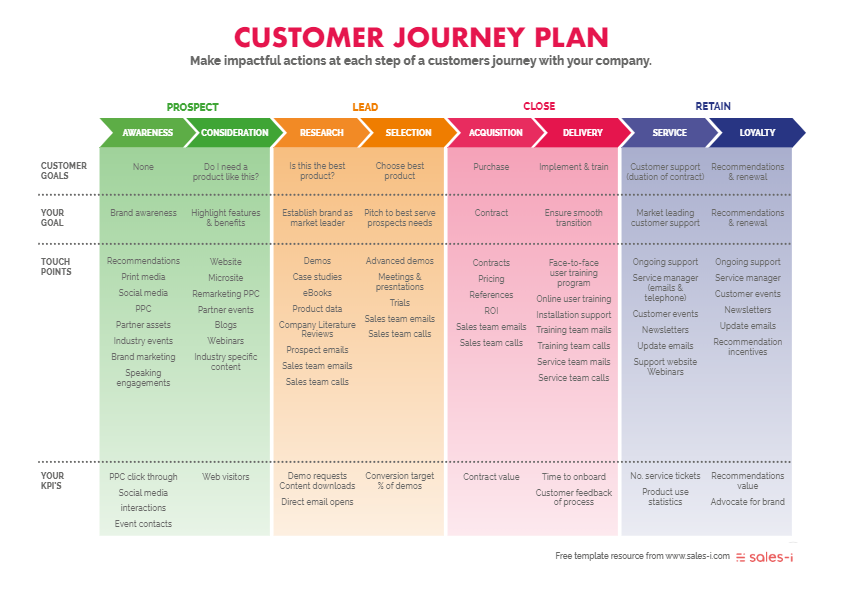

In the ever-evolving landscape of sales, understanding your customers and effectively communicating with them is ...

The holiday season is almost here, andplanning those year-end sales before Christmas can be really overwhelming. There ...

E-commerce has completely changed how buyers and sellers interact, from the emergence of online stores to the rapid ...

In the realm of B2B sales, it is essential to grasp the complexities of human behavior and communication approaches in ...

As the B2B sales industry continues to evolve in response to technological advancements and shifting market dynamics, ...

In the dynamic world of B2B sales, understanding your clients and effectively navigating their needs is paramount. One ...

Human vs machine used to be a fun debate to liven up any dinner party – but with numerous use cases and early adopters, ...

In the world of B2B sales, understanding the intricacies of human behavior and communication styles is essential for ...

In the world of B2B sales, understanding your clients' personalities and communication styles is key to building strong ...

We are now in the digital age. So, what does it mean for sales teams? It means the way that buyers buy and sellers sell ...

A sales intelligence platform is crucial to those salespeople who are responsible for making informed decisions and ...

Customer needs and behaviors evolve all the time, therefore, sales behaviors and techniques can’t be static - and must ...

What is Artificial Intelligence (AI) in sales?

Are you still using revenue as a ‘one-size-fits-all’ solution for your sales strategy?

Are your sales reps reluctant to use your sales intelligence system?

We surveyed 254 sales professionals across the UK and the USA, showing that their career paths may have been determined ...

Preparing for a potential economic downturn can help you protect your business's future.

Taking a customer-focused approach will help to turnaround sales.

When the economy slows down, businesses need to adapt from the ‘business-as-usual’ model and try something different.

It has not been easy to deal with disruptions to the global supply chain, especially those affecting the lumber ...

How sales managers should strategize for better customer experience on economic growth. In this blog post, we discuss ...

Digitalization has only raised expectations for the personal touch in B2B sales.

One sustainable approach that may sound a little abstract, is by improving your customer retention. This approach is ...

Today's distributors and manufacturers have masses of data in their ERP, CRM, accounting, or other back-office systems ...

The last few years of disruption have rattled the sales labor market. Like many industries, the food and drink sector ...

Any successful sales rep will tell you, the key to overcoming objections is to be prepared. Knowing the most common ...

The sales rep's job is to sell, but there are different approaches to product sales, including value selling. The value ...

For many, 2022 feels like it could be the start of a new exciting era, but what could this new world look like for the ...

As fragmented supply chains slowly get realigned in the wake of the pandemic, ongoing shipping and transportation ...

Like every salesperson in manufacturing and distribution, we know it's never too early to think about festive season ...

Pivoting became the new buzzword in sales during the past two years, with swift and entrepreneurial decision-making ...

Many people hear the word recruitment and think: create a job description and throw that up as the advert, and we’ll be ...

The internet is awash with advice for businesses on how to choose software solutions and assemble an effective tech ...

Understanding who your key customers are and who to prioritize isn’t always easy but, in a challenging market, it is ...

Keeping your sales skills at the cutting edge of sales enablement means staying aware of the cutting edge of ...

The construction industry has faced multiple challenges since the advent of the pandemic. With just a brief pause in ...

Industries across the board are struggling to attract and retain new people at every level from graduates to qualified ...

Pricing strategy is a thorny issue for sales teams at the best of times, but never more so than when rising cost ...

Getting your team back on the road in 2021 is going to take creative thinking. More than 97% of the U.S. population ...

What do the US Federal Government, 60 million South African citizens, 57 million Uber customers, and the British ...

Are you in control of your remote sales team? The pandemic has led to major changes in the way sales teams go about ...

B2B selling through social media became increasingly commonplace in 2020 as sales professionals sought added routes to ...

Throughout the pandemic, businesses across the board have been doubling down their efforts to get closer to customers ...

Diversity and inclusion (D&I) can have a big influence beyond your company’s legal obligations and compliance ...

Despite the widescale business disruption created by Covid-19, many companies have responded proactively by ...

In this final part of our series of three articles concentrating on M&A, we focus on how to maximize your company ...

Knowing which businesses and individuals to target to keep your deal pipeline full of the right prospects is ...

In part two of our series of three articles focusing on M&A we turn our attention to the value of embedded ...

In any organization, procedures and policies introduced by individual business functions with the best intentions can ...

2021 is likely to be the year many wholesale distribution businesses find themselves at the end of a Mergers and ...

The intricacies of the different software options available on the market today can leave many business owners ...

Integration is a concept associated with many commercial technology solutions used in a range of everyday scenarios. ...

With Covid restrictions remaining a fact of commercial life for the foreseeable future, the pressure remains on ...

The office. Your companies’ home, the birthplace of every great idea since the industrial revolution. Over the average ...

Busy manufacturers and wholesale distributors could be forgiven for questioning just how much of a priority AI and ...

Whilst many industries have had to cope with unexpected shutdowns, layoffs, and planning a path to survival during the ...

As manufacturing, distribution and wholesaling business seek to mitigate the ongoing effects of the pandemic by ...

It is 2021, yet distribution and manufacturing businesses are still struggling with the age-old ‘user adoption’ issues ...

Manufacturers, distributors and wholesalers hoping for some early New Year cheer are now facing up to the reality of a ...

For many 2020 has been a difficult year. The pandemic strangled import channels, caused multiple lockdowns, and ...

Despite the huge challenges the Covid crisis has brought for sales operations across the UK, the roll-out of a vaccine ...

Cloud services have been steadily gaining in popularity since the early 2000s, and with good reason, they provide ...

Opportunity knocks for industry at forefront of coronavirus fight. Alex Witcpalek, cleaning market specialist and ...

Sector looks to up the tech game in the face of new realities. Alex Witcpalek, industrial market specialist and ...

2020 has presented some of the toughest challenges ever faced by industry across the globe.

With technology that moves your business online, you can stay safe and still sell smart. You can access sales-i ...

(This article first appeared in Builders Merchants News). Coronavirus poses an existential threat to construction ...

With innovative technologies at hand, businesses can still move forward and get the job done even in unprecedented ...

How to remain confident in a challenging and unpredictable environment.

Here are five ways that AI can practically support effective sales strategies for manufacturing, distribution, and ...

Ian Heller shares how you can use technology to help your sales team continue hitting their targets.

Protect your business with sales-i to get instant visibility of potential opportunities and churn risk.

The last few weeks have been difficult for almost everyone, but now is the time to act and put your recovery plan into ...

Building and maintaining efficient sales teams is one of the key challenges of the age for enterprise-level boardrooms ...

Businesses and consumers across the world have benefited from countless web-enabled innovations that make living and ...

The Jaws effect. What it’s going to take to reopen businesses and start selling again?

Being able to pull off an effective video sales call is now a necessity, but it’s not always easy. From technical ...

Many IT service providers have begun introducing new and improved solutions to address their customers’ needs during ...

The more information you capture in my CRM about your customers, the better you will be able to service them in the ...

As the HVAC industry comes out of its enforced COVID-19 hibernation and begins the journey of recovery, who is managing ...

How you use this time in lockdown, will determine how you come out of it. With sales-i by your side, you can maintain ...

Every aspect of the food and drink sector is likely to see change; from dining out, ordering food, supplies and ...

With the 29th March deadline looming, Brexit is a very real challenge facing every UK industry. The automotive ...

Despite the pressures being felt by the distribution sector sales-i customers trading in the Safety equipment sector ...

Are your existing customers your key to growth and potential? In sales, the number one priority is to find new ways to ...

What you want to do, rather than what you have to do. As a sales leader, the clock is always ticking. Reports need to ...

An unpredictable world, such as the one we are currently operating in, requires new tactics. As the world returns to ...

Off the shelf sales enablement tools are the way forward when it comes to aligning sales and marketing according to a ...

The modern workplace is a fast-paced, highly competitive environment. We work harder for longer to maintain a ...

How can you improve your cross-selling techniques? In 2020, 69% of Americans have shopped online and 25% of those do so ...

How will the Jan/San sector provide the much-needed confidence for businesses to return to normal and adapt to new and ...

There’s no doubt that the coronavirus pandemic has hit the economy hard. Many business owners are unsure of where to ...

COVID-19 has inevitably changed the way in which organizations around the world, in all business sectors, conduct their ...

Introducing new technology can seem daunting and complicated, but keeping up with the technological change – while ...

The healthcare industry has evolved faster in the last few months than it has over the past 30 years. From embracing ...

The construction industry worldwide and its complex infrastructure is slowly coming back to life. Tower cranes that dot ...

To demonstrate the value of sales-i throughout a day in the life of a salesperson, we have created a timeline of ...

Digital technology has undeniably transformed the way we do business, with smart technology that is real-time, ...

Article written by Chris Rogers, Account Executive at sales-i.

Could this be the great remote working experiment we’ve all been waiting for? As we continue to figure out how to work ...

How to make the best out of a challenging situation, learn, adapt, and evolve.

Snapshot is the reporting functionality within sales-i that creates customer-facing documents by using sales data from ...

Now is the time to really manage your team. As a manager right now, if you’re separated from your team and unable to ...

For the foreseeable future, we live in a new Covid-19-normal way of business and life. Whether we like it or not, the ...

Remaining a team during social distancing An article by Mike Worthington, Customer Success Manager.

Instead of rushing around the office, being pulled from pillar to post by jumping in on this call and hosting that ...

As it stands, sales-i should be exhibiting at the Manchester Cleaning Show from 25-26th March, however, with the risk ...

Kevin McGirl, Co-Founder of sales-i, shares how sales technologies can (and will) help your business through the global ...

![Optimize your LinkedIn for Sales in 5 minutes [Practical Guide]](https://www.sales-i.com/hubfs/social-network-2-sm-shutterstock_449197306.jpg)

Optimize your LinkedIn for Sales in 5 minutes. Just because you set up your LinkedIn profile does not mean that you are ...

Buying a new sales enablement software tool can be a very exciting time. Yet, 63% of larger companies risk project ...

If you’re struggling to get people to fill vital roles in your business, then you are not alone. The younger generation ...

As the single biggest employer in the United States, we take a look at the heavy duty trucking industry to understand ...

The internet is awash with apps, downloads and business intelligence systems promising to make your work day a breeze. ...

Tip 5: Reverse planning of your sales activity. Sales is one of the few professions where metrics can be captured at ...

Tip 4: The ‘rubber band’ effect. Salespeople are a stubborn bunch. Change is not in their vocabulary.

Tip 3: Understand who your best salesperson is. It’s the end of the quarter and Bob has yet again generated the most ...

Tip 2: The role of a sales manager. It may sound like it’s easy to describe what a sales manager’s role is but so many ...

Tip 1: 173 is the most important number in sales. 173. This number should always be in the back of every salesperson’s ...

What is Data Visualization? Data. If you have a lot of it – and who doesn’t these days – it can be overwhelming. While ...

![HVAC 2019 & Beyond [Infographic].](https://www.sales-i.com/hubfs/HVAC-tool-sm-shutterstock_746019622.jpg)

What are the big trends, opportunities and threats for the global HVAC industry over the next 5 years?

A B2B sales role may seem straightforward; however, in truth, it’s not. Every salesperson needs to consider what ...

The HVAC industry is on the rise. In line with the rebound of fortunes of the larger construction industry, the HVAC ...

The most successful salespeople know the power that a good email can have. In this increasingly digital age, as more ...

When you’re looking for ways to grow your business, you could do worse than using tried and tested up-selling or ...

Is the rush for the latest office tech being overtaken by the need to make sure your tech mindset is right before you ...

Artificial Intelligence (AI) in manufacturing shows the greatest positive impact when compared to other industries. ...

SaaS or Software-as-a-Service has grown ever more popular over the past few years but is it here to stay? Jump back ...

Sales is a numbers game. So we’ve collated some of the most eye-watering, game-changing sales statistics that just ...

The advantages of SaaS (Software-as-a-Service) are significant – regardless of what industry you work in. From building ...

The modern workplace is teeming with tech. Businesses are constantly updating hardware and procedures to keep up with ...

The rise of the machines is well underway, but do you need to worry about your obsolescence? Are the machines here to ...

Practical advice to attract talent.

It’s started. 2018 has witnessed a tsunami of orders for hybrid, electric, and fuel-cell commercial vehicles. FTR ...

Where are we now? Why aren't women going into STEM roles? How do we get more to enter the workforce?

Customer Relationship Management (CRM) software has come on leaps and bounds since the digital Rolodex days and is ...

No one likes a meeting that rambles on, has no plan, no goals and no respect for other people’s time. Making every ...

Are you off to a business or sales conference? Here are our tips for planning your day and making sure you get the most ...

The catastrophic data error which led to case number chaos.

The challenge to attract new customers has become an increasingly fast-paced treadmill in an over-subscribed gym. The ...

The Jan/San industry is a busy market. Finding new growth opportunities can be a mammoth task. There are things you can ...

A Relationship Map is designed to uncover connections between customers and prospects. This can be invaluable when ...

Your company has got a shiny new customer relationship management (CRM) system that is set to revolutionize how you ...

5 powerful metrics that will help you to see where you stand in the retention stakes and offer up some interesting ...

Customer retention can be challenging for even the most seasoned of account managers. In this infographic, we share 6 ...

If you work in manufacturing you’ve probably heard the phrase ‘industry 4.0’ or ‘business 4.0’, first things first, ...

The art of sales is a minefield. If it was easy, we’d all be doing it. With this in mind, we’ve come up with 5 handy ...

The subscription-based sales model is well-known for disrupting the traditional buy-to-own approach. Consumer goods ...

Welcome back to the third part of our 5-point plan to make more hours in your day. If you are reading this article ...

Welcome back to our 5-point plan to make more hours in the day. You can refer to part one for the first two points in ...

B2B sales are notoriously slow in converting prospects from mildly interested to your newest brand evangelists. It can ...

We’ve all said, ‘I don’t have enough hours in the day!’ at some point in our careers. For a sales professional, time ...

Supply chains can set your business apart from the rest. But why not go further and add customer relationship ...

In what is increasingly becoming a heavily commoditized market, manufacturers are constantly looking for ways to add ...

Choosing the right Business Intelligence (BI) system for your business needs is difficult and often very stressful. ...

Our Guide To Building A Successful Sales Team Think of an example of a successful team. It could be a sports team, a ...

How to manage remote employees in 5 steps: You’ve surely heard the phrase, “it’s a small world”. For years, that’s been ...

How to perfect the art of insight selling for your business. Customers don’t want to be coerced into making a purchase ...

Your prospects see countless pitches, so how do you make them remember you and your key points? Using Data ...

In a competitive market businesses need to use every tool in their locker to stand out from the crowd. Using Data ...

Check out our Infographic on how you can harness the power of Data Visualization in your business to make the most of ...

A decade after the economic downturn, the job market has finally started to rebound with jobs being added in nearly ...

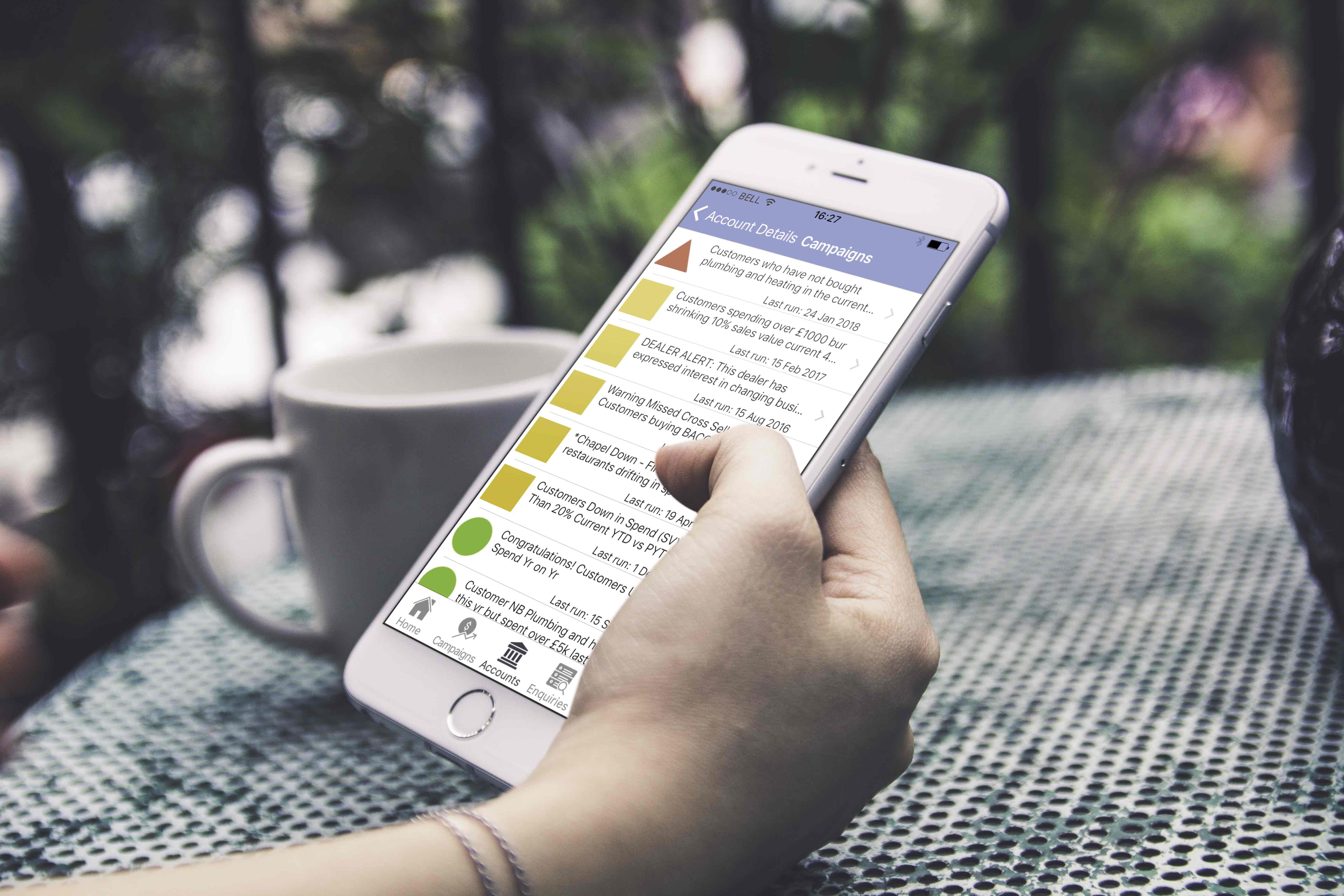

Mobiles, or cell phones depending on which side of the pond you reside, are now a lot more than their title suggests. ...

Sales analytics tools can be a complete game changer for distribution business of all shapes and sizes. From increasing ...

Customer relationship management (CRM) systems are swiftly becoming an essential practice for many companies of all ...

A simple look at Software as a Service, Platform as a Service and Infrastructure as a Service. What are they and how do ...

As a marketeer, I know that all marketing departments are looking for new ways to ‘big up’ their brand, reach new ...

“Acquiring a new customer is anywhere from 5 to 25 times more expensive than retaining an existing one.”

What’s the difference between ERP and BI software? These are two pieces of software that are often confused, muddled up ...

What makes an effective sales goal and how can you make sure that yours will motivate your salesforce to reach their ...

Have you considered SaaS software as a solution for your business? In the battle of SaaS vs on-premise, which wins? ...

Monitor your sales performance using key performance indicators (KPIs). Read on to see examples, how to set them and ...

CRM is changing the way we do business, it's the obvious choice for modernizing customer data collection and bringing ...

From sharing information to capturing leads, here are our top 5 tips on using CRM to increase sales and grow your ...

When you’re trying to grow your business, bringing in new customers or clients left right and centre seems like an ...

Business Intelligence has probably been around a lot longer than you could possibly imagine. But what exactly are its ...

Driving sales performance and developing your business are always going to be at the forefront of your mind. Actively ...

Customer insight is the understanding of your customer, based on their buying behavior, their experiences with you, ...

Hello again, and thank you for joining me for the final installment of our series ‘Sell More Beer 101’. Up to now, we ...

Welcome back to our Sell More Beer 101 blog. So far, we have established that to stand out from the crowd, you need an ...

When used correctly and in perfect harmony, ERP and BI tools are a true match made in heaven. Here are 4 reasons why ...

The New Year is well and truly underway. Most of us have already given up on our New Year’s resolutions, and just ...

You need to sell more beer, but even excellent beer doesn’t sell itself. Your customers and their punters need to ...

Restaurant and food service experts' predictions regarding industry trends for the year had one in common: the need for ...

Worrying about how to forecast sales for your business? Don’t panic - read our top tips on how to create yours now. Has ...

Despite having implemented them into their business, many people still don't know the difference between BI (Business ...

Excellent beer doesn’t sell itself. So, what can you do to come out on top at the bar? Excellent beer doesn’t sell ...

A gazillion (probably not quite – but it must be close) studies have shown that it is much more cost-effective to ...

Businesses often deprioritise maintaining good customer relationships with existing contacts in search of new ones.

The term contact management software used to be synonymous with an online address book. Sure, it could be shared across ...

Considering an ERP implementation in your organisation? We’ve got three reasons to take a cautious approach and plan ...

Regardless of what you may have heard elsewhere, size doesn’t matter – when it comes to implementing CRM software that ...

No one likes change, but when it comes to technology, some people can be particularly resistant. So how can you win ...

As medical supply manufacturers face increasing pressure to bypass wholesalers altogether and turn to e-commerce ...

Here are 99 sales stats that will make you sell smarter:

Improve your ability to understand customer data and share insights with your sales team. The modern business world ...

A successful CRM project requires your users to input quality data. If they put garbage in, they will get garbage out - ...

Lots of things can kill a sale, but the way you interact with a customer should never be one of them. Experts believe ...

What is Predictive Analytics? Predictive analytics uses statistical algorithms and machine learning techniques to ...

A repetitive approach to sales isn’t sustainable for any company, regardless of its shape or size. Without a regular ...

Do you work in customer success? (sometimes known, rightly or wrongly, as Business Development or Account Management) ...

Did you know you can refine, streamline and improve every area of your business, too, through the use of data? To know ...

A customer health score is essential to their retention. Scoring customers' health will alert you to at-risk accounts ...

In 2016, less than 50% of companies had invested in Big Data technologies. While still in its relative infancy in the ...

Here are 5 concepts to help anyone understand just what Business Intelligence is, what it can do, and who it's for. ...

With an estimated 1 billion people using Excel, Microsoft has made a pretty powerful piece of software. Whether you ...

Updating your sales notes in your CRM system is vital for productivity. Although you don't need to add everything, ...

Sales intelligence software (SI) is designed to make a salesperson’s job easier. It looks at your sales data and does ...

Well informed, self-sufficient and on the button sales teams are often the most successful sales teams. With ...

When it comes to using a CRM system, Cloud-based CRM solutions have introduced a completely new way of doing things. ...

When used correctly, CRM (Customer Relationship Management) software is a great way to store masses of information, ...

Enticing the customers through the door is the easy part. Getting them to stay (customer retention) is where the ...

If you haven't made the transition over to mobile CRM, act now to retain your competitive edge. Are mobile sales ...

The who, what, when, why and how of Big Data analytics. “Big Data”. With more than 300 million search results to choose ...

Understanding the limitations of CRM systems, and how to use them effectively.

We make choosing your BI tool a simple and logical decision. A quick Google search of the term Business Intelligence ...

Are you getting nowhere from gatekeepers and prospects that ignore your calls?

Our friends over at Boston University’s MSCIS Program have researched how Business Intelligence (BI) is key to gaining ...

I previously wrote a blog all about firmographics: what they are and what they mean to business. But the one area I ...

Great. You’ve made the decision to implement a Customer Relationship Management (CRM) system into your business. You’ll ...

Data Intelligence solutions can provide serious insight into the best ways to expand your company’s services and ...

Misusing CRM Software can have drastic implications for your business, but how do you avoid doing it? When done right, ...

There’s nothing quite like having a deal in the palm of your hands only to see it slip away.

FBI agents are masters of getting blood out of stones. Read on to learn how they do it. The Federal Bureau of ...

The scale of the packaging industry is not one to be sniffed at. Each person on the planet on average consumes $114 ...

Finding the right CRM system for your business is hard enough without having to get to grips with using it in the most ...

Sales managers are becoming more reliant on data to make better decisions. But what are the common traits of the ...

I’m calling on all salespeople to start thinking about how you approach your job, because in a few years’ time, you may ...

What is BI? And what are the benefits of Business Intelligence? Business Intelligence. It sounds like something made ...

There’s no doubt about it; sales is a highly competitive, results-driven business. That’s why having the right ...

Want to improve your customer retention but not sure how? Sadly, there’s no silver bullet out there with regards to ...

Business Intelligence (BI) data can help companies of all sizes, from all industries, to maximize their profit, ...

Making sales and answering customer queries is one thing, but to truly delve into the mind of your customer takes ...

Having almost taken over the professional world, Business Intelligence (BI) is now used by businesses large and small, ...

What makes some inside sales reps successful, while others fall behind? We look at some of the most common traits that ...

According to The Guardian, the number of new-build homes in England is at a record high since the economic downturn in ...

Avoid making your salespeople CRM puppets and empower them to sell more.

Business Intelligence can be tough to wrap your head around at the best of times, but like most complex concepts, ...

What really bothers salespeople? Why aren’t they winning more business? What’s keeping them from selling more?

Despite having them every day, many business people don’t actually think about the quality of their conversations and ...

Sales negotiations of any kind are by their very nature, uncomfortable and hard work. Here are 7 ways you can negotiate ...

Business Intelligence is growing at an astounding rate. Here are 7 powerful stats that prove just how fast it is ...

What is a sales pipeline? It may seem like a simple question to answer but, in truth, it’s more complicated than you ...

Build trust, read people and adapt to any situation. In sales, you’ll often hear the phrase’ the gift of the gab’, ...

Companies are finally waking up to the power of Big Data. But how can it be used to market to millennials? Millennials ...

The sales-i guide to writing a sales pitch A good sales pitch is the difference between a customer running for the ...

Are you a truly effective sales leader? No, because nobody is perfect. But can you improve? Of course, you can. We ...

The building supplies industry is one of the most difficult to compete in. Here are four tips to help you to get ahead ...

When building a high performing sales team, you need to be able to sniff out an opportunity at any given moment. A high ...

A CEO's role is not an easy one, many assume you can come and go as you please, simply delegate tasks or you are an ...

Customer loyalty is often overlooked by many B2B companies, with them usually looking to new business than retaining ...

It’s often said that it costs at least 5 times as much to find and acquire a new customer than it does to keep an old ...

Implementing sales software in the building supplies industry can be a very effective tool for keeping your business ...

Let’s face it, sales performance has plenty to do with attitude. Do you love to prospect for new business? Do you truly ...

Why investing in Business Intelligence for medical sales is a great way to get ahead of the competition. The medical ...

As CEO of your company, you’re probably overrun with jobs to do, people demanding your attention every other minute and ...

Any software that can alleviate some of the lengthier tasks that come as part and parcel of running a business are ...

Ever been to McDonald’s and heard the question “Do you want fries with that?” This simple question must have earned ...

With the uses of Big Data being so vast, how do companies that use Big Data utilise it specifically for their business ...

Think Big Data is only used in business and marketing management? Think again.

In this article, we’ll give you our take on some subtle, science-based tricks that will make you think twice the next ...

Work in sales? Here are four pieces of technology we recommend. Whether you like it or not, technology is here to stay, ...

Ah, the sales proposal. One of, if not the most important steps in any sales process. A proposal is a crucial document ...

Here at sales-i, we are always interested in understanding what is going on in each of the markets that we work with. ...

An ERP solution will unite every corner of your business into a streamlined, well-oiled machine. But BI software takes ...

There’s never been any real agreement on what makes a great sales team. Is it charm? Or instinct? There’s no right or ...

With Big Data analytics becoming increasingly important in all sectors and industries, we thought we’d outline 4 top ...

Right now is the perfect time to be working in sales. There are challenges (thanks to the past two years), and there ...

Any salesperson will know that there are never enough hours in a day to check everything off their to do list. Our 5 ...

It’s hardly a secret that all salespeople and marketers want to know how to sell more, but it’s easy to get so wrapped ...

Sales referrals are much easier to close than most opportunities, so, how can you increase the number of them coming ...

How can the Cloud encourage productivity in your business? Increased productivity is one of the biggest selling points ...

Today’s market conditions are tough. There’s more competition, advertising and product choice. To survive, every ...

I’m sure you’ve heard of H2H or Human-to-Human selling in the last year or so. While the concept makes sense, is it ...

Big Data has become bigger than ever and its growth is accelerating at an unprecedented rate. This growth rate is ...

In a recent survey by CFO Research, senior finance executives stated that one of their biggest challenges was not ...

Mobile technology is big and only set to get bigger over the next decade. We’re a connected world now. Relying on our ...

You may have seen titles like the above many times when searching the web with no real substance behind the claim. ...

sales-i, the leading mobile sales intelligence solution designed for frontline salespeople, will be attending and ...

The rental market is big business these days and many consider renting to be a viable option. Think about it, over 40% ...

We talk a lot about Business Intelligence here on our blog but sometimes I wonder if everyone reading it really knows ...

If you're a salesperson, these are the smartphone apps you need. In the United States, people spend an average of 151 ...

Technology is great for many things. Using CRM software to monitor and increase customer loyalty is one of them. Here's ...

To start, let’s ask ourselves, “What is an inbound lead?”

Salespeople and pushy salespeople, in particular, don’t have the best reputation. But that doesn’t mean they don’t ...

How can you encourage your team to use new technology and generate an ROI on your company's mobile tech investment? ...

There are many ways you can use Big Data for customer retention. This article discusses 5 which you can start using ...

The UK manufacturing industry is slowly making its comeback, and it has been reported just this week to be enjoying one ...

Most bits of new technology these days simply don’t come with a fully loaded instruction manual like the technology of ...

How can your company use Big Data to get more sales? What shouldn't your company do with Big Data? What on earth is Big ...

The sales profession is constantly evolving and if you compare the sales world of today with that of 15 years ago, the ...

Technology for salespeople is a no-brainer. But have you thought about finding the right technology for salespeople in ...

Big Data and Big Data research got the nod of approval from UK Government earlier this week in the annual Budget, with ...

Businesses and their customers are even more impatient at finding answers today than ever. BI software gives them the ...

Business Intelligence is changing the manufacturing landscape. This article explains four key reasons as to why ...

As a relatively easy way for companies to stay on top of their game and keep customers on side, the countless benefits ...

Sales process engineering sounds pretty terrifying doesn’t it? It’s not. It is simply a way of applying scientific or ...

Every year the IT industry is talking about a new hot topic, and this year it’s been all about Big Data. Many big names ...

The 80/20 rule is fundamental to every business. Stepping into another lecture at University I was greeted by yet more ...

Converting prospects into paying customers is always a testing point in the sales process. If you embrace the skills ...

Your business is more than just a product or service; it’s about people too. The way you treat people is important for ...

Business is tough, and retaining customers is often even tougher. What with new products being launched, competitors ...

Below are five reasons why Mobile BI is fast becoming a global phenomenon in businesses.

The basics of business fundamentally stay the same, however, it’s how you communicate, manage and your decisions that ...

Ahhh, the age-old question, “should your sales and marketing teams be aligned?” This is a topic that throws up a few ...

Jump on Google and do a quick search for marketing quotes and you’ll probably come across this one, “I know that half ...

This year is opening up new growth opportunities for the building supplies industry. But what can you do to ensure your ...

Business Intelligence (BI) has evolved and is now becoming accessible to small and medium-sized businesses but how can ...

Nearly 800 million members. 200 countries. Nearly 20 years. LinkedIn has come a long way since its birth back in May ...

Here at sales-i, we are proud to have an extensive network of partners that we work closely with. For today’s post, we ...

Managing sales. All-important but often overlooked. Yet today, a truly worrying number of sales managers are so used to ...

Many salespeople approach negotiations as battles to be won rather than challenges to be solved. The challenge is for ...

CRM is now a fundamental part of every business but where did it originate from and how has it evolved? There’s no ...

Every company I’ve worked for has always had a sales team putting pressure on Marketing to provide ‘leads’, which is ...

Customer Relationship Management (CRM) is becoming increasingly prevalent in today’s business world. But where does the ...

The amount of pressure on sales reps is incredible. With targets to meet, month end always just around the corner and a ...

Competition, ferocity and motivation make us all tick. Doing something that bit better than the person sat next to you, ...

Triggered email campaigns are helping companies of all sizes to sell better to their customers, improve conversion ...

We all know that familiar saying, “you need the right tools for the job”, and in the business world, this is no ...

It’s true, there is a certain art to being a great salesperson. While there are certain personality traits and ...

Working in sales is not easy. Ridiculously early starts, high-pressured days and painfully late nights as every month ...

Neil Saviano, President of CRM International (one of sales-i’s valued partners), has recently published an article ...

Firmographics help companies understand that their customer’s needs go beyond the easy-to-track demographic data they ...

There is a constant debate as to whether a good sales person is born or made – and whether selling is an art or a ...

There’s nothing like the threat of impending difficult economic conditions to set sales team on new offensives, firing ...

As the global economy struggles and sales teams delve deep into their consciences about wasting fuel on poorly planned ...