For many 2020 has been a difficult year. The pandemic strangled import channels, caused multiple lockdowns, and resulted in furloughed staff and job losses for many manufacturers, wholesalers, and distributors in the construction industry. Yet, we enter the festive period with positive news!

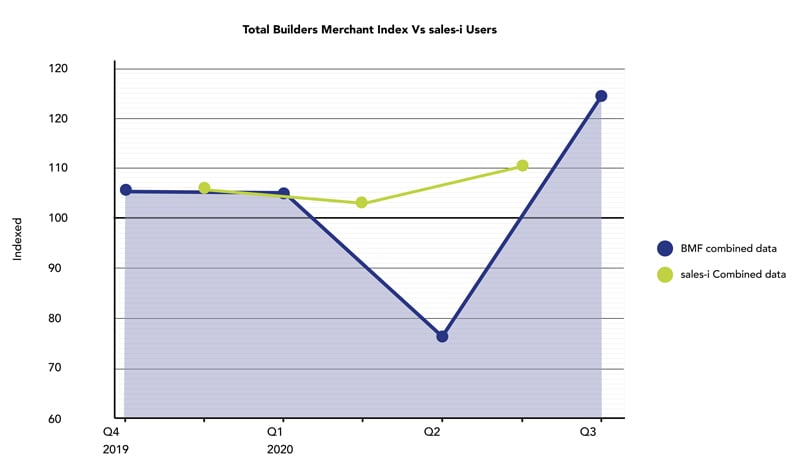

Recent figures released by the Builders Merchant Federation (BMF) show how 2020 has been a tale of two halves for the building and construction industries. As grim as the situation looked for every construction segment in Q1 and Q2, the bounce back has been significant enough to put most companies’ year-on-year figures back in the black.

The decline

BMF figures showed a continuous growth for its members from 2016 onwards. Q4 2019 saw the first signs of a slowdown in the upward trend with figures across the various product segments dropping below their regular increases of the previous years.

BMF compared to sales-i

But that slowdown was nothing compared to the impact COVID had in Q1 and Q2 2020 which proved to be the most difficult period for the industry. Unsurprisingly sales tumbled below the BMF’s 2015 baseline figures. The combined data for BMF members showed revenue dipped to around -23% under the baseline figure.

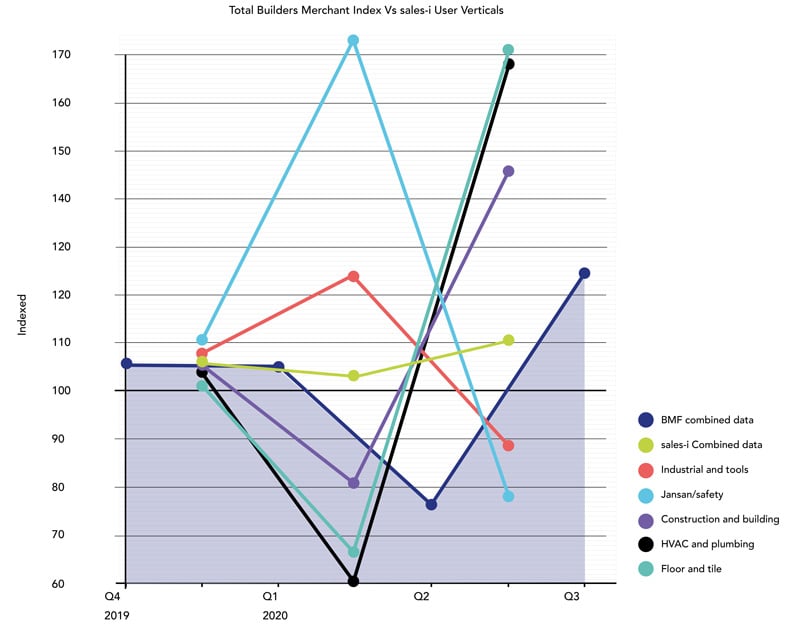

In contrast, the average for sales-i users in comparable industries managed to offset the decline with a Q1 growth of +6.53% and Q2 of +3.29% above neutral. Contributing most to the positive growth was the Safety sector sales-i users who recorded a strong period of growth Q1 to Q2 of 72.91%. Whilst an extreme increase in demand for safety products may be understandable during a public health crisis, this wasn’t the only vertical to defy the downturn.

sales-i users in the Industrial and Tools sector recorded increases from Q4 2019 to Q1 2020 of +7.72% with a continued rise in Q1 to Q2 of +23.59%

The V shaped recovery

Despite the dramatic impact of the pandemic, the majority of sectors have bounced back to a state of growth, even if that is marginal for some verticals.

The BMF report shows ten out of twelve verticals returning to positive growth by the close of September 2020. This was a strong response to the challenges of 2020 and delivered an average growth across BMF members of +24.6% YoY.

From the product categories reported on in the BMF report that can be directly compared to data as collected by sales-i, sales-i users achieved growth of 18.34%, higher than the BMF’s average.

The standout year-on-year results for sales-i users include safety and hygiene with a +48.78% and Industrial and tools with 18.83% YoY. Overall, the year-on-year sales for sales-i users in the construction and building supplies industries* has increased +15.14%. (YOY) An outstanding result after a turbulent year.

2021

2021 is likely to be unpredictable for the construction industry, even more so with the yet-to-be-confirmed post-Brexit landscape having to be considered. COVID-19 will continue to impact supply chains and cause regional fluctuations in product and service demands and the industry will need to continue to adapt quickly to these changes.

To survive and thrive next year will require new ways of working that aid teams to make insight-led decisions. That’s where sales-i can help. Contact our team today to find out how our cloud software can help you halt margin erosion, up-sell complimentary products and boost your sales.

*Figures have been calculated using data from sales-i users that best match BMF product categories. Not all sub-categories are represented due to comparable data restraints.