2020 has presented some of the toughest challenges ever faced by industry across the globe.

From crippled supply chains, health lockdowns, and unpredictable shifts in demand, the best route back to growth has been almost impossible to map.

Industrial Supplies, Safety & Tools sector

The Industrial Supplies, Safety & Tools sector has experienced a mix of both positive and negative results due to the effects of the COVID-19 pandemic. The negative is the sizeable decline in industry productivity and the drop in demand for tools. However, the spike in demand for PPE and safety equipment provided a welcome financial boost.

“The COVID-19 pandemic is expected to have a positive impact on the market.” Grand View Research.

In the Eurozone, after an initial boom post-lockdown, industrial production output in August has slowed to a modest 0.7% increase from the previous month (Source: Deloitte). In the US, industrial production was down 0.6% from August to September, the first monthly decline since April (Source: Federal Reserve).

Overall the results for the whole sector are looking healthy when compared to many other sectors, with a post-lockdown boost that is now leveling out to show a marginal year-on-year increase.

Sector products aiding recovery.

In a varied sector, a few product lines have been stepping up to steady sales.

PPE

The explosion in demand for PPE has been a big contributor to the wider sector’s continued growth as the second spike of COVID-19 infections takes hold for the winter in many regions. The longevity of the increased activity for the PPE market is expected to extend far beyond the end of the pandemic.

“Increasing awareness of workplace safety is one of the major factors which drives the growth of global personal protective equipment market.” MarketWatch

In the UK, stockpiling for the winter months, coupled with the return to normal business channels for companies that diversified into safety wear and alcohol gels at the height of the crisis, has maintained the high demand for PPE.

A focus on using local suppliers rather than depending on overseas supply channels, which failed at the peak of the pandemic, is providing a much-needed boost to local economies. Along with more comprehensive incident planning and preparedness in all workplaces, a higher level of demand for PPE is expected to become commonplace.

Automated machinery

Despite healthy order books, many manufacturing, wholesale, and distributors saw their fulfillment processes come to a sudden halt due to the lockdown. This reliance on close proximity human-centric processes had a major impact on many businesses' ability to function.

In response, CNC’s (Computerized Numerical Control) has become the focus of modernization planning. The reasons for the increase in investment in automation have been threefold. Firstly, automated systems can reduce the timeline for many industries with full-order books that are now playing catchup. Secondly, a process that is less dependent on onsite employees safeguards against such a dramatic impact on business in the future. And finally, the third benefit is to reduce close proximity work for onsite employees to protect the workforce from future health risks.

Metal Cutting and forming tools

Metal cutting and forming tools have led the way in the manual tool market. This is thanks to the quick market recovery in construction and to a lesser degree, aerospace and shipbuilding.

How do sales-i users compare to the wider sector?

From our recent data investigations, sales-i users in the Industrial Supplies, Safety & Tools sector have seen sales skyrocket this September and found themselves on the positive side of the performance figures.

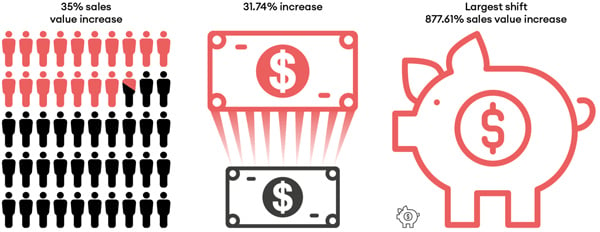

US

Comparing September 2019 with September 2020 figures, our users in the US have achieved an outstanding total sales value increase of 31.74%. In fact, one customer reported a staggering 877.61% increase compared to sales for the same period last year.

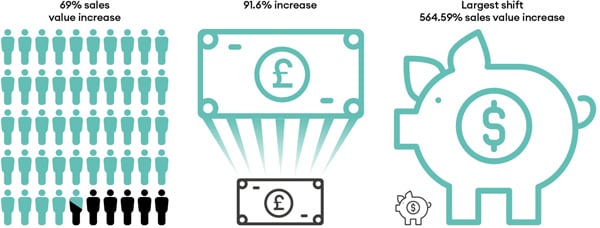

UK

Meanwhile, our users in the UK have also achieved excellent results, with 69% reporting growth at an average of 91.6% increase. The overall sector saw a total sales value increase of 57.87%. The highest increase in the UK hit an impressive 564.59%.

With results from the whole sector showing a slowdown in growth, sales-i customers both side of the pond appear to be resisting the downward turn and can look forward to 2021 with some cautious optimism, but it won’t happen without some forward planning.

sales-i, the right tool for the job

According to EY.com, all businesses should be preparing for a future where “Disruption is the new normal”. The pandemic has raised the bar when it comes to natural disasters impacting productivity, one that, due to its global impact, has been difficult to mitigate. However, this has been one in a series of smaller country or continent-contained incidents that have interrupted supply chains. The need to switch out the previous reactive response to a preventative response is finally being recognized and implemented as the industry begins to rebuild.

Beyond the shop floor, sales-i can provide the actionable insights your sales team needs to take advantage of every sales opportunity to grow your business.

Book your demo today to find out how sales-i can help your business sell smart.