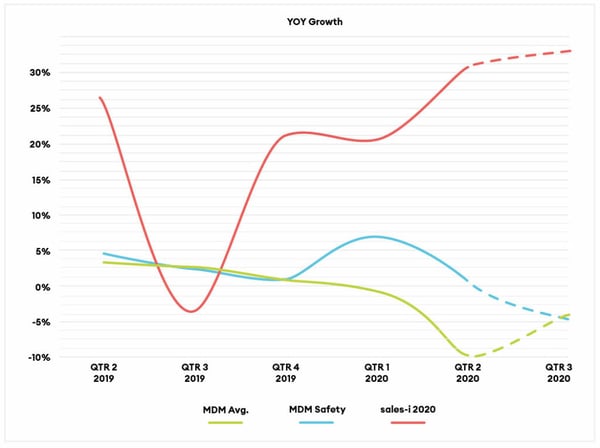

Despite the pressures being felt by the distribution sector sales-i customers trading in the Safety equipment sector have seen growth figures 28 points higher than the sector average over the last quarter.

Trusted industry voice MDM (Modern Distribution Management) has compiled data from members across the U.S. to better understand the big picture of the distribution sector performance throughout the pandemic.

Within the report MDM have taken a closer look at a series of sub-categories, such as Safety, which has allowed for a direct comparison of the MDM data to sales-i users.

MDM and the Safety Sector.

Showing a less turbulent shift in year-on-year sales per quarter, the sector has continued to grow during the pandemic. As one of the perceived ‘winners’ of a health crisis, distributors of safety equipment have had an increased importance during the last six months. But, as the figures reflect, profits have still been impacted due to issues beyond demand, such as delays in the supply chain.

The Safety sector results for the second quarter of 2020 have reduced to a marginal growth rate of 0.6%. This is still an impressive feat when compared to MDM’s combined results that shows distribution sector sales declined by -9.8% year-on-year (yoy) with industry-wide positive growth not expected until 2021.

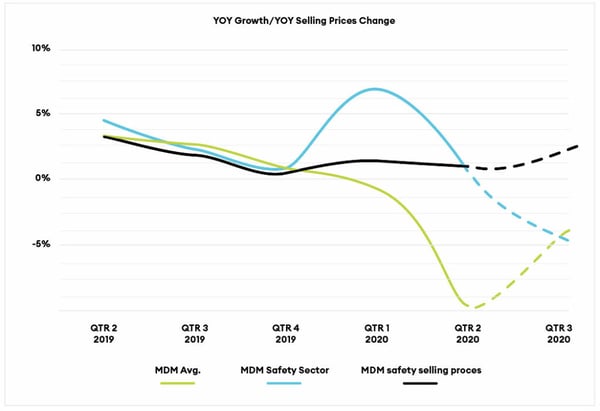

Safety Selling Prices.

According to MDM, the selling price yoy growth for the Safety sector has tracked a similar pattern lower increases as revenue growth. From a peak in 2019 quarter two of 2.5% growth the figures for quarter two 2020 dropped to a growth in prices of just 0.9%. The Safety sector will be feeling the pinch of reduced selling prices, but is fairing much better than the sector worst hit sector, Gypsum, who are facing a -4.3% price decline.

Safety supply chain challenges.

As with many industries, the Safety distribution sector has felt the impact of the global interruption to supply chains. Delays to parts for manufacturers, increased customs holding periods for overseas products, and higher demand have put pressure on wholesale distributors to meet order commitments. Even with many businesses being awarded ‘essential’ status, shutdowns and intermittent supply have resulted in reduced capacity as companies furlough or lay off workers to protect their long-term survival. With less staff and both volatile supply and demand, distributors have been stretched to deliver anything near ‘business as usual’.

The sales-i advantage.

Whilst the figures from MDM show a sector decline by 0.6% compared the previous year’s growth of 4.6%, the story for Safety distributors in the U.S. that use sales-i very different.

In contrast to minor fluctuations and decline in quarter two of 2020, our users are enjoying a significant period of growth. Picking up the pace from 2019 quarter three, our customers are leveraging the actionable insights sales-i delivers to produce growth 27.85 points above market average.

“Given the importance of data, analytics, and technology to both engaging customers and executing the value chain, wholesale distribution organizations should also leverage IT to truly energize not just enable the business.” Deloitte.

Whilst a multitude of factors will be at play, such as the specific products, sector sub-categories, existing contracted work, and so on, the increase is big enough to raise the question – how is sales-i helping them buck the trend of negative yoy growth?

Kickstart your business growth.

sales-i enables sales professionals to clearly identify and target high-quality sales opportunities within their current customer base. Equipped with customer buying behavior alerts, salespeople can make insightful, personalized, quick business decisions, realizing repeat sales, reduced customer attrition, and maximized profit margins as a result.

If you’re anything like most wholesale distributors, 80-90% of your annual revenue will come from your existing customers, and sales-i uncovers the information you need to sell more to this group.

While trading conditions might be tough right now to enable your business to lead business sector growth over the coming months, your team will have to be proactive and seize every opportunity. Now may be the moment to review current processes, reskill your team, or invest in a new technology to streamline operations and make them more effective.